Tokenomics 101: Supply & Demand

Mar 27, 2022 . 4 min read . 429 views

title: 'Tokenomics 101: Supply & Demand' publishedAt: '2022-03-27' summary: 'Tokenomics is the Math & incentives governing crypto assets. In recent years, this phrase has been used a lot...' category: '#web3 #deFi'

Tokenomics is the Math & incentives governing crypto assets.

In recent years, this phrase has been used a lot by founders and investors to understand and explain the viability of a crypto project.

To evaluate the tokenomics of a crypto project just like conventional economics we are going to be looking at the Supply and Demand of the tokens.

Evaluating Supply

When evaluating supply we don't care about the utility of the token all we need to understand is how the supply of the token will change over time.

Is the token "Deflationary" or "Inflationary"?

Key questions to ask:

- How many of these tokens exist right now? (What is the current supply or market circulation)

- How many will ever exist? (What is the total supply)

- How quickly are new ones being released? (What is the emission rate)

Deflation

The token’s value increases if fewer tokens exist. e.g: Bitcoin (capped total supply at 21M)

Inflation

The tokens value decreases if more tokens exist. e.g: Dogecoin (unlimited supply of tokens)

Emissions are the rate at which new tokens are released. e.g: For Bitcoin, the emission rate is cut in half every 4 years or so. i.e it has decreasing emissions.

Does the token have a fair distribution?

Fair token distribution is important to differentiate scammy projects from good ones. If a bunch of investors have 25% of the supply and those tokens will unlock in a month, you might hesitate before buying in.

Key questions to ask:

- Do a few investors hold a ton of the tokens which are going to be unlocked soon?

- Did the protocol give most of its tokens to the community?

- How fair does the distribution seem?

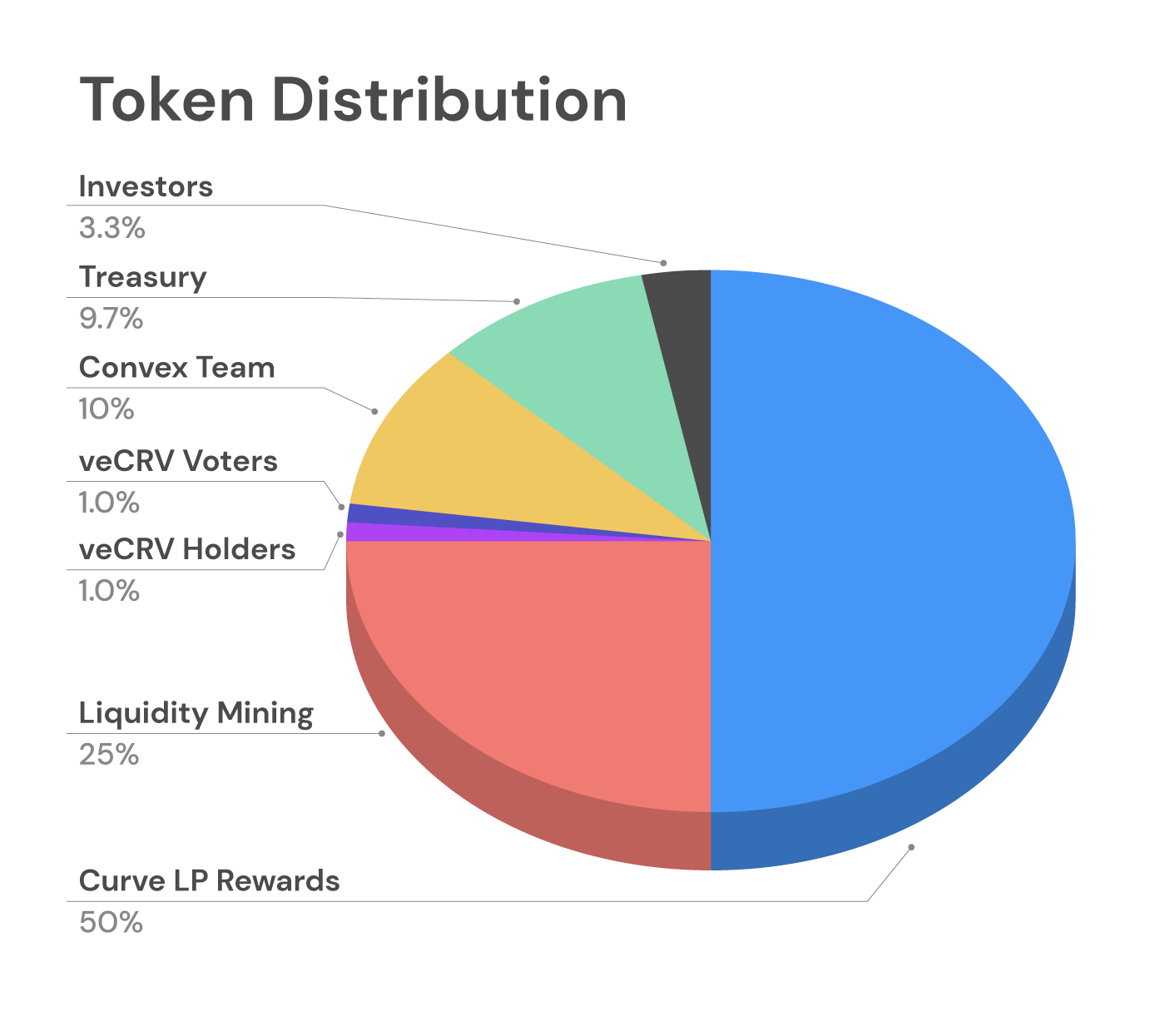

An example of fair distribution. The team and investors together own less than 20%.

An example of fair distribution. The team and investors together own less than 20%.

Evaluating Demand

Supply alone is not enough to understand a crypto project. An asset might have deflationary supply yet if it does not have demand it's not valuable.

What's the return on investment (ROI) the token can produce?

2 main ways people can get an ROI through tokens

- Staking

- Rebasing

Staking

Staking is a way of earning rewards for holding a cryptocurrency. You earn this reward because the blockchain puts your crypto back to work. Think of this like the interest rate you get from your bank for depositing your savings.

Ethereum is a good example of staking where the protocol gives 5% to stakers.

Sushiswap is another example where people earn a percentage of the protocol's revenue in exchange for providing liquidity to the exchange.

Rebasing

Rebase, or elastic, tokens are cryptocurrencies that automatically adjust supply levels to maintain a constant value. Think of these like stock splits.

The holders of rebase tokens get more of the token when the protocol inflates its supply by staking it.

Belief in the future

When all is lost belief can move mountains. Evaluating people's belief in a project is hard as belief is intangible. Yet there are a few ways in which you can measure it.

- What’s the energy like in their Discord?

- How active are they on Twitter?

- Do people make this token or protocol part of their identity?

- How long have people been active in the community?

Bitcoin is a great example of a project with long-term belief.

Bitcoin has no cash flow, no staking rewards, nothing. It just has the belief that it could be a long-term store of value to rival gold.

Game Theory: Are the incentives designed in a way that makes the project sticky?

Game theory asks you to consider additional elements in the tokenomics design that might increase the demand.

A few examples of game theory in Defi projects:

- Curve gives stalkers additional rewards based on the amount they stake and the time duration they stake. This is similar to different FD rates provided by banks.